We’re on a crusade to evaluate companies like Credit Clean Australia based in Southport, QLD to make sure they’re up to the task of getting people out of debt.

It’s our belief that all Australians have the right to get themselves fully out of debt before they retire. There are several companies now offering people to clean their credit reports. Do they work? Well, we had to check it out.

We had this interesting experience with Credit Clean Australia that we want to share in this review. Read this first before joining them!

Because it’s important that you get the facts.

Credit Clean Australia Review

We’re starting to get a bit frustrated here with the state of the Australian economy right now. As a country, we have the biggest personal debt load of the entire western world.

Can you sense a recession of depression happening soon? We certainly can!

Luckily, there are companies around that can genuinely help you. We had a positive experience with Credit Clean Australia recently and thought we’d share our direct experiences here.

Now the black mark on the credit history wasn’t all that bad. It was from 2 years ago but we were a bit sceptical as to how long it would take to erase.

We had heard from others that this process could take up to 6 months. We couldn’t wait that long! The whole idea is that we would get a clean credit history then apply for a debt consolidation loan at reasonable interest rates.

In our opinion, that’s often a good idea for a beginner on the journey towards a debt-free lifestyle. You can use the lowered monthly repayments to knock off the debt faster.

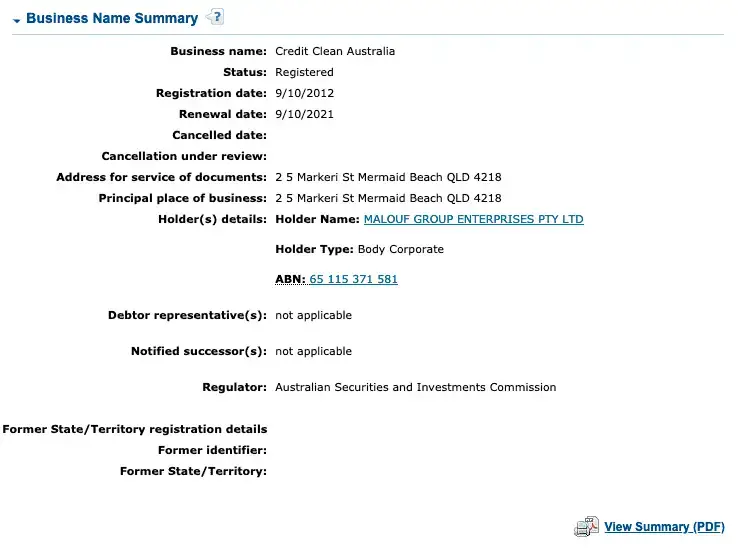

Before we started though, we had to validate that Credit Clean Australia is legit.

That is the ASIC extract for Credit Clean Australia which you can view here.

Did we say that we check things properly here? The Debt-Free Community has your back!

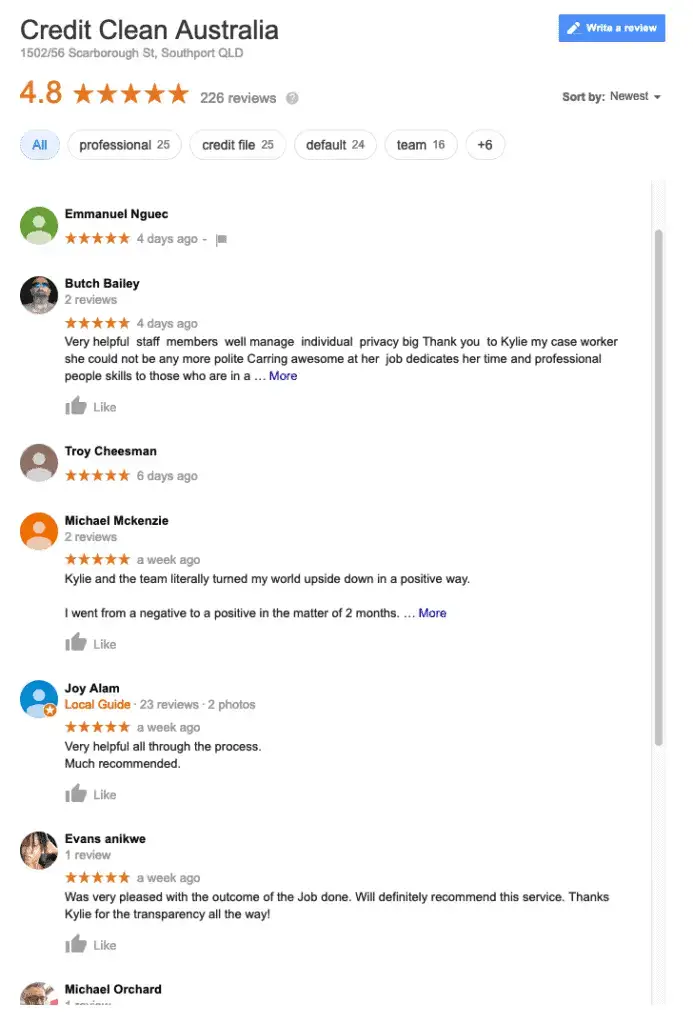

We checked online reviews for Credit Clean Australia and were impressed:

Those are real names and real people. We encourage you to read through the whole lot.

Real customer testimonials

We found that there are numerous real people who have left testimonials. Let’s have a look here:

Credit Clean Australia removed an electricity default.

They can also help in clearly Telstra defaults.

RACQ placed a default on Jeremy’s credit history but Credit Clean Australia got it removed!

All in all, we can clearly see some real results here.

We decided to try it

Yep – we recruited a friend of ours who had not one but two black marks on her credit history:

- An unpaid Vodaphone bill from 9 months ago

- A default from a personal loan from 2.5 years ago

Tanya, our friend, really wanted to have her clean credit history within the next 2 months. She was hopeful to apply for a debt reduction loan and wanted a great interest rate.

She knew that if lenders saw the black marks, then she’s either going to get reject or be given some pretty ordinary loan terms. Like many Australians, she was on a quest to get herself out of debt.

On the initial phone call, we got her to ask a whole bunch of questions. All up it was 27 questions and we imagine the person on the other end of the phone was totally over it! What we were keen to know is if they are indeed knowledgeable and use local Australian staff.

See – Credit Clean Australia is based in Southport on the Gold Coast. Tanya spoke to 3 different people and each was based locally. Other companies actually exist in Philippines or India so you’re not talking to a local with real knowledge.

So what were the results at the end of the day? Successful. Both those black marks were removed but it didn’t come cheap though. Tanya weighed it up and she was massively in-front with the reduced interest rates on her debt consolidation loan.

How much did they charge?

That’s the question on everyone’s mind: How much does it cost to use Credit Clean Australia? It’s $1195 including GST for 2 negative listing removals on Australian credit reports if you use Credit Clean Australia. That’s expensive or cheap, depending on your priorities.

They use a no-win, no-fee structure. They will refund you if it doesn’t work.

What you need to think about is the damage if you don’t do it. Like you could be stuck paying a super high-interest rate.

Let’s say you wanted to take out a car loan because you got a new job. Well, there is a big difference in repayments between 9% and 27%. Suddenly paying the fee to these guys doesn’t seem so bad.

At the end of the day, we wouldn’t advocate that you really use them to take on more bad debt. You don’t need any more credit cards or personal loans. Use them to get yourself a step forward in life instead of living on struggle street.

In summary: Should you use them?

The answer is pretty obvious: It worked for Tanya our friend, so yes, you should! Credit Clean Australia clearly knows how to get rid of negative listings on credit reports.

At the same time, they are a bit pricey on the fees. That is the biggest negative that we raise to keep this review fair and balanced.

What you need to do is weigh up your options. If you’re not intending to take out finance in the next 12 months, then they’re probably not a good use of your funds.

On the other hand, if you’re starting the journey towards debt elimination, then they are a fantastic starting point. Use them and then consider a consolidation loan. Your monthly repayments might be much less than you’re paying already.

The only way to know for sure is to get in touch (1300 739 860) and find out for yourself. Likewise, why not get in touch with us here as well? The Debt-Free Community strives to help people just like you with a free discovery call! ?